Zions Bank Press Release

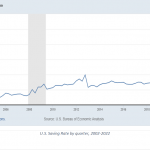

The U.S. savings rate has fallen to its lowest level since George W. Bush was president and most Americans were carrying flip phones. The personal saving rate — the percentage of people’s income left over after taxes and spending — sunk to 2.9% in the fourth quarter of last year, its lowest level since 2005.

Persistent inflation and rising interest rates have eroded savings gains made during the pandemic, when the savings rate hit an all-time-high of 34% in April 2020. Today, less than half of Americans have $1,000 in savings, according to Bankrate.

“The falling saving rate shows many people are struggling financially and lack a financial cushion,” said Mel Hugentobler, manager of Zions Bank’s Castle Dale and Huntington branches. “While rising costs have made it more challenging to save money, taking small savings steps can help make a big difference in your overall financial health.”

In honor of America Saves Week, Feb. 27 through March 3, Hugentobler offers six tips for building and maintaining personal savings:

Start small. Save frequently and in small amounts. Starting with small goals can make saving more manageable. Many experts recommend having three to six months worth of living expenses on hand for emergencies. If this seems overwhelming, start with a more attainable goal of $1,000 in emergency money. (You’ll have it in six months if you save $77 per biweekly paycheck.)

Be specific. Instead of setting a general goal to “save more,” pledge to save a specific amount per paycheck or per month. An easy way to do this is through automatic payroll deductions or automatic transfers from checking to savings. If you get a raise, increase the amount of money deposited into your savings account; even a 1% increase can go a long way toward your savings goals.

Save the third paycheck. If you get paid every other week, there are two months of the year when you will receive three paychecks instead of two — a 50 percent raise for the month. Instead of using this “extra” money on a splurge, set aside some or all of it to boost your savings. Similarly, unexpected windfalls, like a tax refund or monetary gift, can be a great way to beef up savings.

Take advantage of both short-term and long-term savings vehicles. A basic savings account or a money market account is a good choice when saving for short-term needs like car repairs. For long-term goals, like saving up for a home or retirement, consider bonds, Individual Retirement Accounts, mutual funds, real estate and stocks.

Determine needs versus wants. Do you need to eat out every day for lunch? Do you really need three different TV streaming services? To hang onto more of your hard-earned money, look closely at your spending and cut out the nonessentials.

Remember your purpose. Whether you’re saving for college, a car, a down payment or a rainy day, saving with a purpose will help keep you motivated. During America Saves Week, you can take a savings pledge and create a simple savings plan to build and maintain your savings.

About Zions Bank

Zions Bank is Utah’s oldest financial institution and is the only local bank with a statewide distribution of branches, operating 95 full-service branches. Zions Bank also operates 26 branches in Idaho and Wyoming. In addition to offering a wide range of traditional banking services, Zions Bank is a market leader in small business lending. Founded in 1873, Zions Bank has been serving the communities of Utah for 150 years. Additional information is available at www.zionsbank.com. A division of Zions Bancorporation N.A., Member FDIC.