A special meeting was hosted by the Carbon County Commission on Thursday evening to answer questions submitted by community members regarding the previously-approved 2020 municipal tax increase.

Beginning the evening, Commission Chair Larry Jensen reminded all of the group effort to remove the increase and reduce the tax back to its original amount prior to 2020. With many questions circulating and speculations rising, the commissioners deemed it important to offer a forum where questions could be submitted and answered.

Nine questions were received prior to the meeting with one coming in by phone, eight by email and two from in-person visits. It was said that the submitted questions would be answered not necessarily one-by-one, but in a general conversation to help all understand the ‘why’ behind the increase.

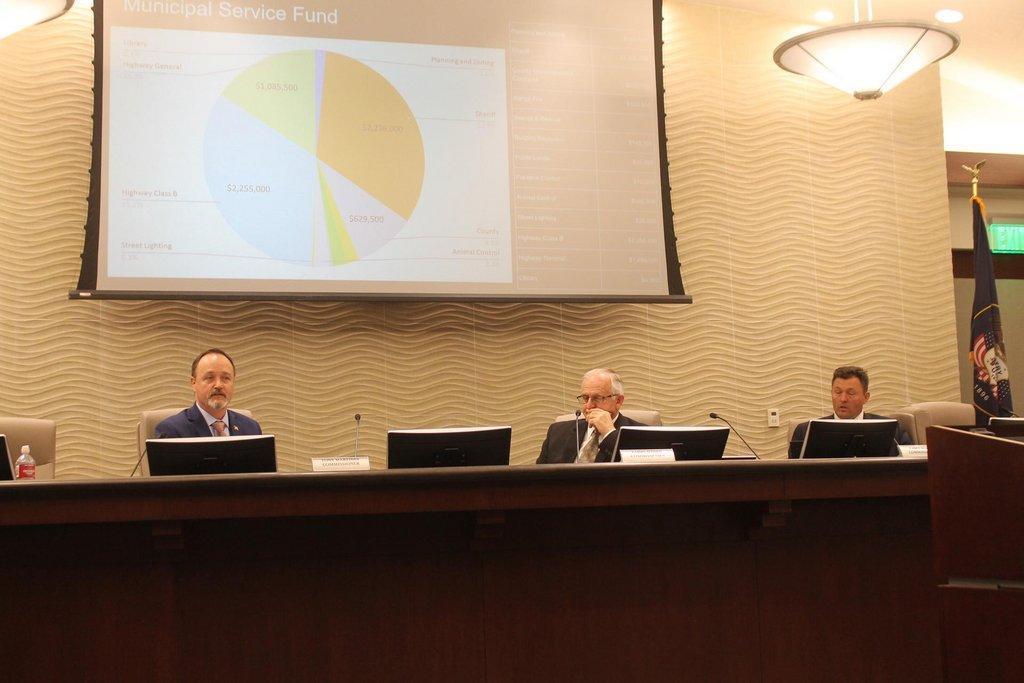

Commissioner Casey Hopes then took the helm, accompanied with a prepared PowerPoint presentation to assist in the details. He pointed out that all of the information can also be accessed on the State Auditor’s website by going through a public portal to see the numbers specific to any governmental body. Following this, he showed ten years of actual mineral lease monies received.

This year, it is projected that the county will bring in just over $500,000. These monies are created from coal mining, oil and natural gas extraction, and from any minerals coming off federal grounds. In 2013, Carbon County received just over $7 million, which was split between debt payments, county contracts and more.

In 2020, around $829,000 was received and this year is just over the $500,000 mark, showing how the received funds are continually decreasing.

There was also a question proposed on what the county has done to reduce spending. While Commissioner Hopes stated that the county is not in a hiring freeze, they are only hiring positions that are absolutely needed to fill vacancies. Many adjustments are still being made, including not having seasonal workers this year.

He then broke down what is all included in the municipal services fund, such as the sheriff’s office, the road department, dispatch and more.

Commissioner Tony Martines then took time to discuss money comparisons. With the tax increase, a resident in unincorporated areas pays just over $1,800 while a resident in Price City would pay $1,772, which is just over $63 dollars in comparison. In Helper City, the same house would be $1,872 with a difference of just over $35.

In Wellington City, a resident would pay $1,843, a difference of about $6.50. East Carbon residents pay $2,228, which a significant difference of $391.71. Commissioner Martines wished to point out that, though nobody likes a tax increase, all come to expect services, paved roads and an ambulance department, and none want to cut services.

“This has been an ongoing thing for several years and our intent is to save where we can,” stated Commissioner Martines, who also remarked that they are doing what they can to save dollars and not spend where it is not needed. That is not just being done by the commissioners, but all county employees, he said.

Carbon County Assessor Gillian Bishop spoke next, thanking the commissioners for giving the office the opportunity to speak. He said this is a good opportunity for tax payers and residents to gain an inside look on their purpose. The assessed value of a property times the tax rate equals the revenue or budget. In assessed value, they look at three things: income approach, cost approach and the sale comparison approach.

Bishop stated that the centrally assessed tax shift from 2016 dropped and has been steadily declining, but the budget must still be accounted for. There has been nearly a $102 million drop over a four-year period in the value of properties.

Following Bishop’s remarks, Carbon County County Attorney Christian Bryner took to the podium. He wished to highlight the question on the denial of the submission to have the tax increase rescinded on the ballot. There was an application submitted to the Carbon County Clerk/Auditor’s Office in early 2020 by five county residents, he explained.

The first thing that Bryner explained was that when the county receives an application to circulate a petition, it must be considered as submitted. They are unable to waive the statutory requirements that are associated with submitting a referendum or petition and they cannot modify the application in any way. Some of the requirements include timeliness, the residency of the submitting person and more.

Within 20 days after the day on which a voter files an application for a petition, the county shall review the application to determine whether it is legally referable to voters and will notify those that submitted it whether or not it is. Bryner stated that the petition was not timely filed and was determined by more than one party.

From there, the District Court tossed out the lawsuit of the sponsors that claimed their application should have been processed. Bryner stressed that this was not a political decision or made by any of the commissioners, but was a matter of meeting the legal standard.

Commissioner Jensen spoke on other concerns, such as residents of the incorporated parts of the county who believe that their taxes were raised, which is false. The school district bond was the only thing that was attached to the city’s taxes, he explained. There are others that are concerned that the increase imposed gave the commissioners a raise, which is also false.

Another false statement, according to Commissioner Jensen, is the idea that scheduling a meeting with the commissioners is difficult. He stated that if there are questions, the community is welcome to visit. He said that during the working hours of each work day, at least one of the commissioners can be found at the administration building.

On business growth, it was stated that there are nine expansions of local businesses that are moving forward and the county was involved heavily with four them. Eight businesses that are either here or in the process of moving here were also announced, with 48 new jobs that have been created in the last two years. In addition, 25 new hires are expected in 2021.

Many efforts have been made by the cities as well as Carbon and Emery counties to work together on economic development. “We’ve decided there’s no county line when it comes to economic development,” stated Commissioner Jensen. He then remarked that the Intermountain Electronics expansion is a large win, with an expectation to hire 270 new employees over the next five years.

Commissioner Hopes then expressed appreciation for everyone that serves on the board and is helping with many of the projects, assets and more. “Everybody that’s contributing to the growth in our community, I just wanted to express my appreciation,” said Commissioner Hopes.

In conclusion, Commissioner Jensen stated that the goal with the increase was to even out the taxes for all of the areas within the county, which is really what was accomplished. “We take this very seriously. We did a year and a half ago when we started thinking about what we could do,” stated Commissioner Jensen.