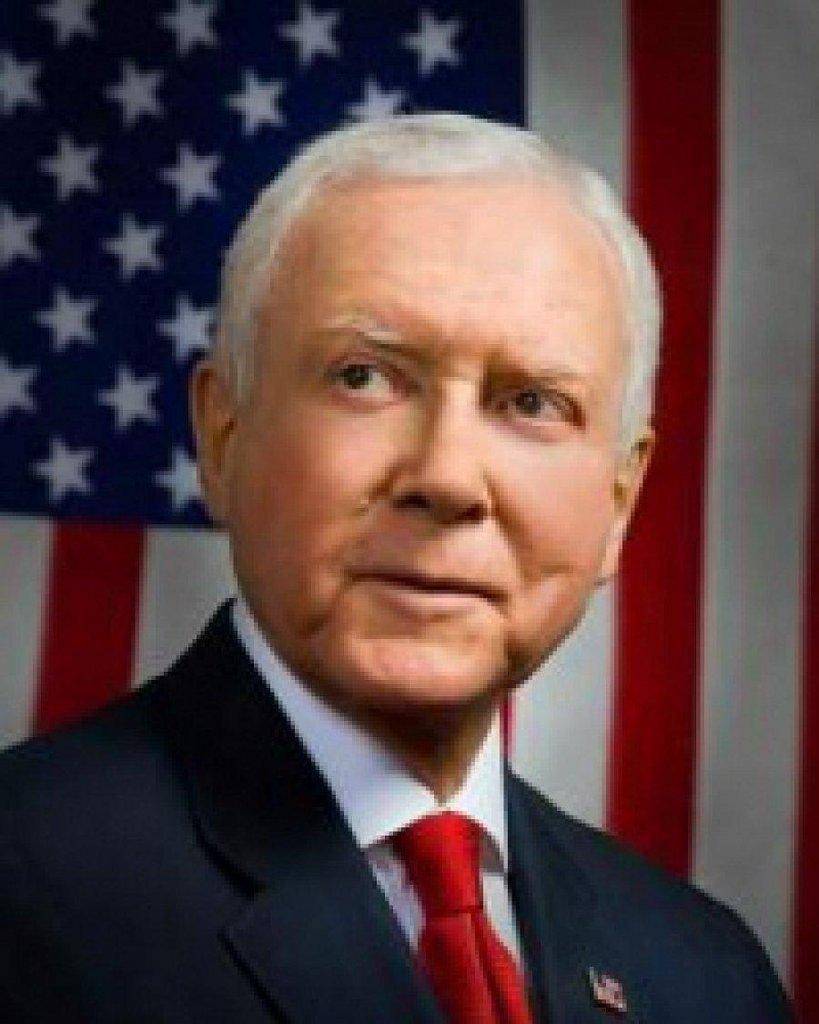

U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, led 40 colleagues in urging Senate Majority Leader Harry Reid (D-Nev.) to take immediate action to stop the largest tax increase in history, set to take place on January 1, 2013 unless the President and Congress act to prevent it.В In the letter, the Senators outlined the economic dangers posed by these tax increases and that they stood ready to work to ensure all taxpayers are protected.

“If Congress and the President do not act by the end of this year, American taxpayers will face $310 billion in tax increases next year. This would be, without any exaggeration, the largest tax increase in American history,” the Republican Senators wrote. “The failure to extend the expiring tax relief — tax relief previously supported by President Obama — would hit all taxpayers, undermine small businesses, and be a dangerous drag on the economy.”

To view a signed copy of the letter clickВ HERE.

Below is the full text of the letter:

May 17, 2012

The Honorable Harry Reid

United States Senate

Washington, DC 20510

Dear Leader Reid:

We are deeply concerned about the nation’s fiscal health. The failure of Democrats in Congress and the President to support aggressive policies that will facilitate robust long-term economic growth and job creation continues to undermine our fragile economic recovery. Economic growth slowed to 2.2 percent in the last quarter, down from 3.0 percent at the end of last year. For 39 consecutive months, the unemployment rate has remained above 8 percent, and that only tells part of the story. 12.5 million Americans are unemployed and, of those, more than 5.1 million workers have been looking for work for 27 weeks or more. Furthermore, 7.9 million workers are working part time for economic reasons, and another 2.4 million have only a marginal attachment to the labor force.  There are close to 2 million college graduates who are unemployed, and the best thing that anyone could do to relieve their debt and improve their situation is to promote job creation.

Yet there seems to be little urgency on the part of the Administration to enact pro-growth policies. President Obama spent much of the first half of his presidency working to pass his health care law, which creates $2.6 trillion in new government, but does nothing to create jobs. Nowhere is the lack of attention to this economic and jobs crisis more evident than with the Administration’s cavalier attitude toward the coming fiscal cliff that The Washington Post has termed “Taxmageddon.” If Congress and the President do not act by the end of this year, American taxpayers will face $310 billion in tax increases next year.  This would be, without any exaggeration, the largest tax increase in American history. The failure to extend the expiring tax relief — tax relief previously supported by President Obama — would hit all taxpayers, undermine small businesses, and be a dangerous drag on the economy.

The adverse impact of these tax increases on economic growth is unquestioned. It is our understanding that last week Federal Reserve Chairman Ben Bernanke reconfirmed in a discussion with Senate Democrats that the nation faces a “fiscal cliff” so significant that the Chairman said that monetary policy would not be capable of offsetting the resulting decline in economic growth. And the former Director of President Obama’s Office of Management and Budget concluded that what he estimates to be a $500 billion tax increase would be so large that “the economy could be thrown back into a recession.” The impact of this fiscal cliff might actually be understated. Billions in new taxes on capital that were enacted as part of the President’s health care law come online in 2013, and they will almost certainly dampen economic growth even further.

The fiscal cliff is not the only danger imperiling our economy. In addition to the massive scheduled tax hikes, budget cuts from the sequester that followed from the Administration’s failure to arrive at a budget are scheduled to hit in the near term. According to the magazine The Economist, the Congressional Budget Office has found that the combined effects of the sequester and the expiring tax relief would add up to 3.6% of GDP in fiscal year 2013. In a $15 trillion economy, that would be a hit to GDP of $540 billion which would surely tip us toward recession and even more job losses.

Instead of addressing this fiscal cliff, President Obama and Congress have spent much of the past year advancing misguided redistributionist policies in the name of fairness. The American people have made it clear that they are not interested in politically-motivated redistribution of wealth. Taxpayers know that the surest way to achieve fairness and equality is by giving people greater opportunity. They want Congress and the President to foster conditions for economic growth and job creation. The opportunities that will come to individuals and families — to purchase a home, send a child to college, or start a business — as a result of economic growth far outweigh those that come from efforts by Washington politicians to redistribute wealth in the name of fairness.

The fiscal cliff that the nation is approaching is utterly predictable. It is essential that Congress and the President address these coming tax increases this summer, rather than creating additional uncertainty for families and job creators by waiting until the last possible minute. The time to begin is now. Inaction is irresponsible. As the President remarked recently, this being an election year is “not an excuse for inaction.” Indeed, the President concluded that “[s]ix months is plenty of time for Democrats and Republicans to get together and do the right thing, taking steps that will spur additional job creation right now…”

We can think of no better steps to take than to address the recessionary threat of Taxmageddon and eliminate some of the uncertainty that continues to contribute to economic malaise. Action now will also help return our economic environment to one with sustainable economic growth and less debt, which will allow interest rates to normalize. Years of near-zero interest rates — even repressively negative rates once adjusted for inflation — have been starving our seniors of much-deserved pension and other investment incomes. We cannot delay and cause even more prolonged harm to the balance sheets of our cherished senior citizens.

We look forward to working with you and the President to prevent the historic tax increases that we all know are scheduled to take place in the near term, helping us secure liberty and economic opportunity for all Americans.

Sincerely,

Senator Orrin Hatch (Utah)

Republican Leader Mitch McConnell (Ky.)

Republican Whip Jon Kyl (Ariz.)

Republican Conference Chair John Thune (S.D.)

Republican Policy Chair John Barrasso (Wyo.)

Senator Lamar Alexander (Tenn.)

Senator Kelly Ayotte (N.H.)

Senator Roy Blunt (Mo.)

Senator John Boozman (Ark.)

Senator Richard Burr (N.C.)

Senator Saxby Chambliss (Ga.)

Senator Daniel Coats (Ind.)

Senator Thad Cochran (Miss.)

Senator John Cornyn (Texas)

Senator Mike Crapo (Idaho)

Senator Jim DeMint (S.C.)

Senator Michael Enzi (Wyo.)

Senator Lindsey Graham (S.C.)

Senator Chuck Grassley (Iowa)

Senator John Hoeven (N.D.)

Senator Kay Bailey Hutchison (Texas)

Senator James Inhofe (Okla.)

Senator Johnny Isakson (Ga.)

Senator Mike Johanns (Neb.)

Senator Ron Johnson (Wis.)

Senator Mark Kirk (Ill.)

Senator Mike Lee (Utah)

Senator Richard Lugar (Ind.)

Senator John McCain (Ariz.)

Senator Jerry Moran (Kan.)

Senator Rand Paul (Ky.)

Senator Robert Portman (Ohio)

Senator James Risch (Idaho)

Senator Pat Roberts (Kan.)

Senator Marco Rubio (Fla.)

Senator Jeff Sessions (Ala.)

Senator Richard Shelby (Ala.)

Senator Olympia Snowe (Maine)

Senator Patrick Toomey (Pa.)

Senator David Vitter (La.)

Senator Roger Wicker (Miss.)