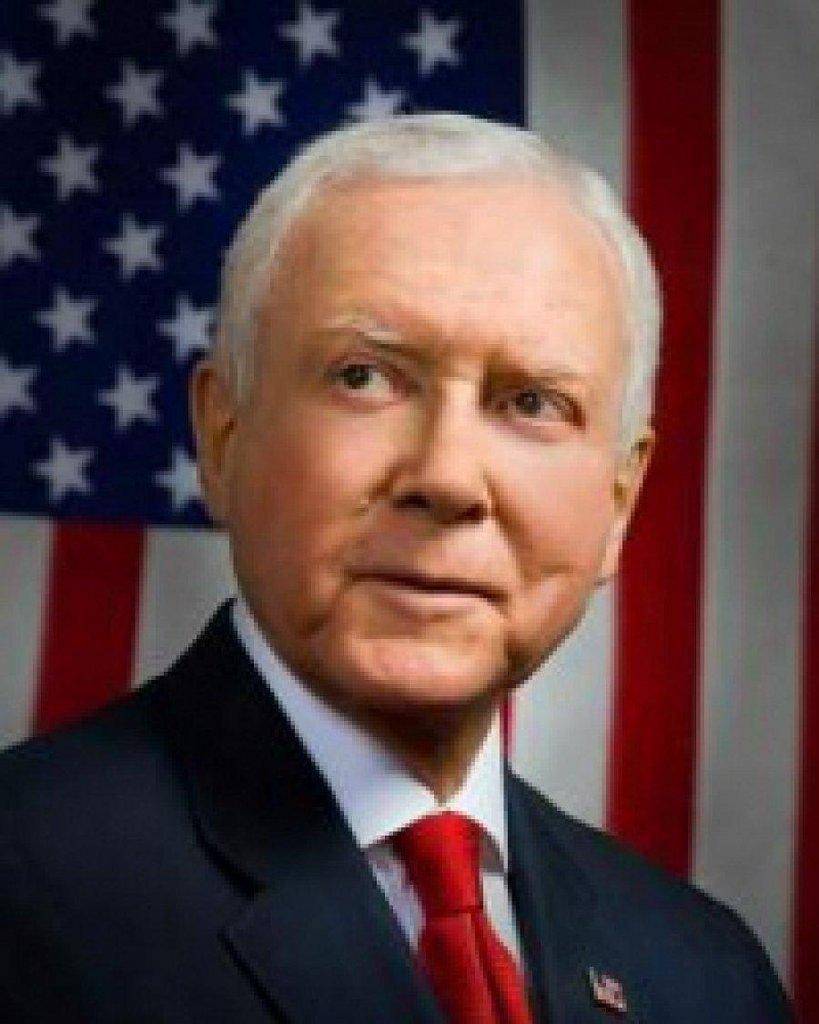

U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, says in the Weekly Republican Address that raising taxes on small businesses, as Senate Democrats voted to do this week, is the wrong solution in the middle of an economic crisis. “This isn’t the time for political games and vilifying job creators. The President and his Washington allies need to stop holding America’s economy hostage in order to raise taxes on those trying to lead our economic recovery,” said Hatch, the ranking Republican member of the Senate Finance Committee. Hatch has put forward a Republican plan that would extend all of the current tax rates while working to undertake a long overdue overhaul of America’s broken tax code next year. The Weekly Republican Address is available in both audio and video format and is embargoed until 6:00 a.m. ET, Saturday, July 28, 2012. The audio of the address is available here, the video will be available here and you may download the addresshere.

A full transcript of the address follows:

“Hello. I’m Senator Orrin Hatch of Utah.

“It’s sometimes hard to see how the policy debates in Washington affect you sitting at home. But there’s a significant debate taking place that could put nearly every American on the hook to pay more taxes to Uncle Sam.

“In just over five months, middle-class families, job creators and seniors will get hit with a massive tax hike unless the President and Congress act.

“This would mean that taxes would go up on virtually every single taxpaying American.

“The Alternative Minimum Tax—designed decades ago to ensure that 154 wealthy Americans paid some income taxes—would then hit 27 million Americans with a $92 billion tax hike next year alone.

“Now, what would this cost you?

“A family of four earning $50,000 a year would see a $2,200 tax hike.

“If you’re a single mother with a $36,000 a year paycheck, you’d pay $1,100 more to the government.

“A married couple over 65 with $40,000 in income would see their tax bill double.

“And just under one million small businesses, who are trying to lead our economic recovery, would be hit with as much as a 17 percent tax hike. Think about that—one million job creators with less to invest and create jobs.

“This just doesn’t make sense.

“The uncertainty caused by this tax crisis—or Taxmageddon—is contributing to America’s lackluster economic recovery. That’s not a Republican talking point; that’s based on what job creators across the country are saying.

“Like Brent Gines from Sandy, Utah, who said that, вЂAny increase in expenses or outlays always has a big decrease on our ability to do business.’

“Or the 90 percent of small businesses who told the Chamber of Commerce that they are very concerned with Taxmageddon.

“Or Federal Reserve Chairman Ben Bernanke who told Congress that our country’s economic recovery, вЂcould be endangered.’

“The Congressional Budget Office and International Monetary Fund have both issued warnings as well.

“Taxmageddon doesn’t have to happen, and the last few weeks have offered a clear choice about how we can stop it.

“As the top Republican on the Senate Finance Committee, I put forward a common-sense plan to prevent this massive tax increase, so we can undertake a long overdue overhaul of America’s broken tax code next year.

“Unfortunately, Washington Democrats’ default position appears to be to let everyone’s taxes skyrocket, if Congress doesn’t agree to their plan to raise taxes on one of the most productive segments of our economy.

“The group charged with representing small businesses found that 25 percent of our workforce is employed by those very small businesses that would be hit by the President’s proposed tax hikes.

“And a study by Ernst & Young found that these looming tax increases would shrink the economy by 1.3 percent and shed 710,000 Americans from the workforce.

“Raising taxes as our economy continues to struggle is not a solution, and the majority of Americans and businesses understand that.

“The President once understood that as well. In 2010, he said that allowing these same tax increases вЂwould have been a blow to our economy, just as we’re climbing out of a devastating recession.’ Forty Democrats in the Senate agreed—joining Republicans to stop these potentially devastating tax hikes.

“That was the right position then, and, with grim news this week that economic growth is weaker than it was two years ago, it’s the right position today.

“Regrettably, Washington Democrats have abandoned that common-sense position opting for a campaign message instead. This week Senate Democrats voted on a partisan proposal to increase taxes on small businesses and jack up the death tax—hitting 24 times more farms, ranches, and over 13 times more family businesses—by as much as 55 percent.

“The good news is their bill won’t become law with the House of Representatives set to pass bipartisan legislation next week ensuring that no one gets an income tax hike.

“Now, the President may not think that small business owners are the ones who actually built their business, but the President and his Washington allies need to listen to what you, the American people are saying. Republicans are listening, and that’s why we put forward this common-sense plan to extend all the current tax rates, as we did in 2010, so we can work together next year to fundamentally reform our broken, costly tax code.

“What will tax reform look like?

“It should mean lower tax rates to promote more hiring, investment, and a stronger economy.

“A simpler tax code should make it easier for people to invest in new businesses, pay for our children’s education, and give money to charity.

“This isn’t the time for political games and vilifying job creators. The President and his Washington allies need to stop holding America’s economy hostage in order to raise taxes on those trying to lead our economic recovery.

“Let’s roll up our sleeves to ensure that America remains the leader we know it to be.

“Thank you. May God bless you, and our great country the United States of America.”