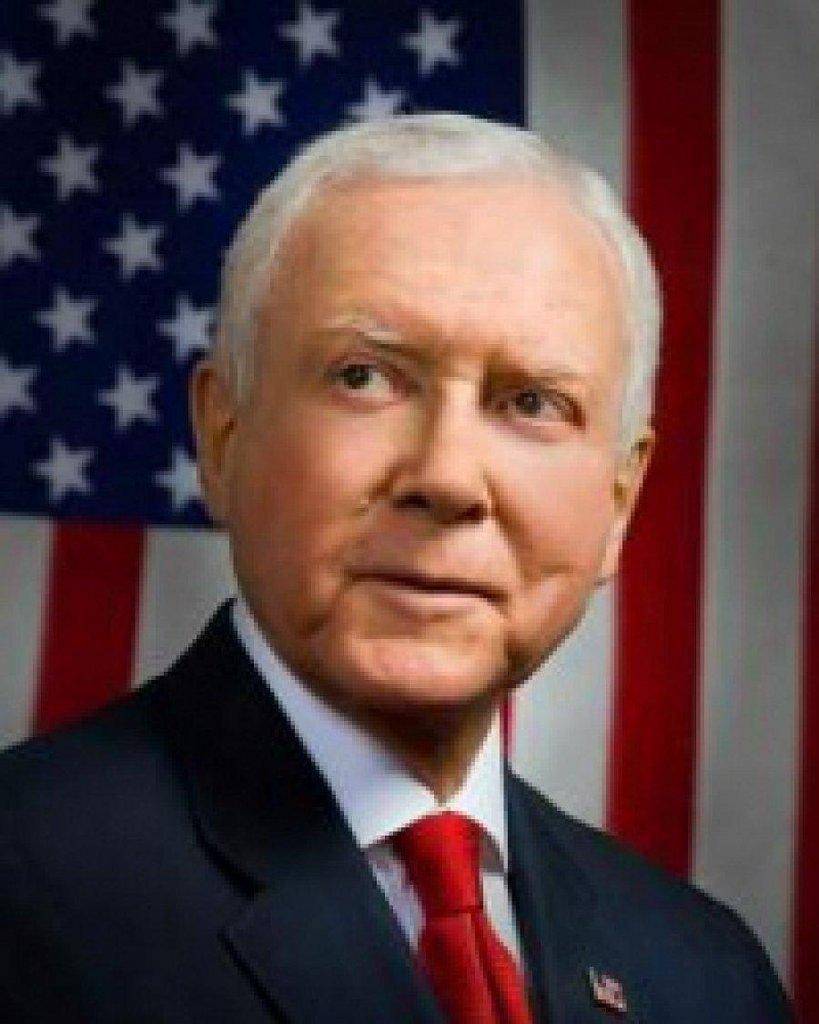

The Government Accountability Office (GAO) released a report showing that very few small businesses are taking advantage of small business tax credits, included in the President’s health spending law, due to how difficult and confusing it is to claim those credits. U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, said this report shows how bad the law is for small businesses, since these tax credits are supposed to help them, and how much worse it will be if the law comes fully into effect in 2014.

“The failure of these small business tax credits goes to the heart of what’s wrong with ObamaCare: it’s confusing, expensive, and burdensome for the families and businesses that have to comply with it. It’s no surprise that the very part of the law that the White House said would help small businesses is, in fact, too difficult and complex for small businesses to take advantage of – and that’s before the worst parts of the law for America’s job creators come into effect. This would be ironic if it weren’t such a tragic indictment of the President’s failed health law,” said Hatch. “Instead of admitting that this is a yet another failure, the President wants to expand this program so he can say he’s doing something for America’s small businesses.”

The President’s Council of Economic Advisors estimated that “4 million small businesses are eligible for the credit if they provide health care to their workers.” Yet, GAO found in its report that only 170,300 small employers have claimed it. In large part, this was due to the incredibly complex formulae for determining which employers are eligible for the credit, and how much they are eligible for. The GAO report “found the tax credit to be complicated, deterring small employers from claiming it” and said the complexity, “arises from the various eligibility requirements, the various data that must be recorded and collected, and number of worksheets to be completed.”

GAO’s findings mirror those of a November 2011 Treasury Inspector General for Tax Administration report that found that, “the number of claims for the small business health care tax credit was much lower than anticipated.” Despite the complexity and low participation in the tax credit the Administration proposed to “expand the group of employers eligible for the credit….” as part of its budget proposal for fiscal year 2013.