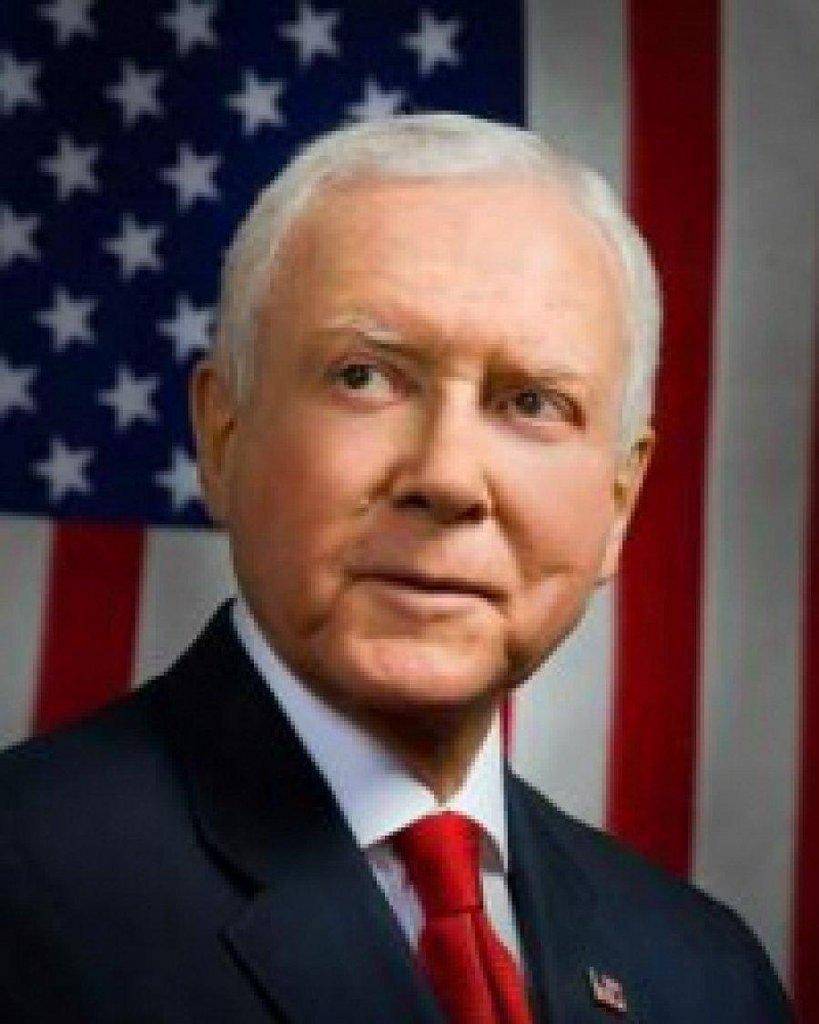

U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, today slammed Senate Democrats for blocking Senate consideration of both President Obama’s small business tax hike plan and a Hatch amendment to extend the 2001 and 2003 tax relief for one year.

“Fair is fair. We have our proposal. We want to keep taxes low for all Americans, particularly with our economy on the ropes. And the President has his proposal. He wants to raise taxes on small businesses, even as the prospects for economic growth and job creation look increasingly bleak,” said Hatch. “So let’s have a vote. Let’s get on the record. Our constituents sent us here to make hard choices. It’s time to put our money where our mouths are.”

This week Hatch filed amendment #2491 to S. 2237, the Small Business Jobs and Tax Relief Act, which is currently being debated in the Senate. The Hatch amendment would extend current tax policy through the end of 2013 and instructs the Senate Finance Committee to undertake comprehensive tax reform during that time. This morning, Senate Republicans offered to compromise and allow a vote in the Senate on the President’s small business tax hike plan in exchange for a vote on the Hatch amendment. The Senate Democratic leadership outright rejected the offer.

Hatch continued, “And keep in mind that Democratic leadership is not just filibustering the President’s tax increase proposal. That leadership is also filibustering my tax relief proposal. And I suspect that they are filibustering this amendment because they are afraid it would pass. 40 Democrats in this chamber supported the extension of the 2001 and 2003 tax relief in 2010. And they would probably do so again, if they had a chance. So the Democratic leadership has decided to deny them that chance.”

Below are Hatch’s full remarks delivered on the Senate floor this afternoon:

Mr. President, this really is an amazing moment. Sometimes for those watching on CSPAN, the Senate, with its unique rules, can seem like a pretty arcane place. The impact of unanimous consent requests are not something that ordinary folks talk about.

So let me put this in plain English. The Senate’s Republican Leader just made a remarkable offer to the Democrats. We hear all the time from the left that Republicans refuse to do anything in the Senate. Remember this episode the next time you hear that.

My friend and colleague, the senior Senator from Kentucky and Republican Leader, Mitch McConnell presented this body with an opportunity to take a stand, to take a vote, and to show the American people our cards on the most important issue facing this country — the coming fiscal cliff.

In exchange for a vote on the amendment that I introduced to extend all of the 2001 and 2003 tax relief for one year, the Republican Leader agreed to a vote on the President’s counter-offer that would increase taxes on families and small businesses.

You heard that right. The Republican Leader offered a vote on President Obama’s plan to raise taxes. And the Democratic Leader rejected this offer.

Senate Democratic leadership turned down an opportunity to vote on President Obama’s tax increase bill — the bill that he insists is the only acceptable way to address the fiscal cliff.

After today all of the President’s surrogates, if they are honest, will have to rewrite their talking points about do-nothing Republicans in the Senate. Senate Democratic leadership is effectively filibustering President Obama’s tax increase bill. Did everyone out there hear that?

They are filibustering their own bill. So what does that tell us? Here’s what it tells us. It tells us that the President’s tax increase plan is not just an economic disaster; it is a political loser.

It tells us that in spite of the big talking from the President’s Chicago reelection campaign about evil Republicans who want to extend all of the 2001 and 2003 tax relief, vulnerable members of the Senate’s Democratic conference do not want to be anywhere near the President’s tax increase alternative.

To borrow from the film Top Gun, the President’s campaign is writing checks that Senate Democrats can’t cash.

Or as we Westerners like to say, the President is All hat — No cattle. He’s tipping his tax increase Stetson, but he does not have enough of a herd in the Senate to follow him.

And keep in mind that Democratic leadership is not just filibustering the President’s tax increase proposal. That leadership is also filibustering my tax relief proposal. And I suspect that they are filibustering this amendment because they are afraid it would pass.

40 Democrats in this chamber supported the extension of the 2001 and 2003 tax relief in 2010. And they would probably do so again, if they had a chance.

So the Democratic leadership has decided to deny them that chance. The President is asking for compromise. Well, he is looking at it.

As the Ranking Member on the Senate Finance Committee, I have deep reservations about temporary tax policies.В Temporary tax policy does not provide the certainty to small businesses and families that are necessary to long-term planning and investment.

If a small business does not know what its tax bill is going to be next year, they are not going to be doing any hiring.

So it is not surprising to me, with next year’s tax rates up in the air, that we just saw the worst quarter of hiring in over two years.

But in the interest of preventing a tax increase that would further hamper the economy, I am willing to set aside the virtue of permanency for the time being.В My amendment would just extend the 2001 and 2003 tax relief for one year.

The amendment that I have filed with my friend, the Republican leader, is in itself a compromise.

But we have offered a further comprise. Fair is fair. We have our proposal. We want to keep taxes low for all Americans, particularly with our economy on the ropes. And the President has his proposal.  He wants to raise taxes on small businesses, even as the prospects for economic growth and job creation look increasingly bleak. So let’s have a vote. Let’s get on the record. Our constituents sent us here to make hard choices. It’s time to put our money where our mouths are.

If the President and his party really think that it is morally reprehensible to extend all of the 2001 and 2003 tax relief, then vote against it. If they really think that raising taxes is the way to go, then vote for the President’s plan.

Mr. President, I wish I could say that I was shocked. But this is just par for the course. I know that the handwringing Washington pundits like to blame Republicans for the lack of progress on the fiscal cliff.

But this episode should show once and for all what a fiction that is. Republicans are ready to act. They are ready to vote. We can vote on my amendment to extend tax relief to all Americans and on the President’s proposal to deny that tax relief to small businesses. We can do what our constituents sent us here to do. We can vote. And let the better plan win.

But Democratic leadership, fearful of the embarrassing reality that their own conference has serious reservations about the President’s tax hiking agenda, is now filibustering President Obama’s signature tax policy. Those who continue to talk about the President’s reelection prospects in glowing terms need to reevaluate that narrative.

President Obama thinks that the ticket to his reelection runs through tax hike valley. He is going to succeed where Walter Mondale failed. President Obama’s signature economic policy is a promise to raise taxes on job creators when we are facing our 40th straight month of unemployment in excess of 8 percent.

You do not need to do a sophisticated poll to figure out how popular this policy is in swing states or with independents. Just look at what happened here this morning.

Republicans offered a vote on the President’s plan and Democrats balked at the opportunity. Democrats are filibustering President Obama’s signature domestic policy — a bill to increase taxes.

And they are doing so because many members of their own conference know that a vote for these tax increases would sink them back home.

Mr. President, this is a pathetic spectacle, made even more so by the fact that time is running short. The fiscal cliff is approaching and families and businesses need to know what their tax rates will be next year. To date the Senate’s Democratic leadership has done nothing to provide that certainty.

It really is disgraceful what we are witnessing this morning. We need to put politics aside and have these votes. Mr. President, I renew the Republican Leader’s unanimous consent request and ask that we immediately proceed to debate and votes on my amendment to extend tax relief to all Americans and on the President’s tax increase plan.

President Obama seems to think that he has a winning issue here. It might be good for him, but delaying resolution of these tax rates is putting partisan goals ahead of the common good. The American people deserve better than this.