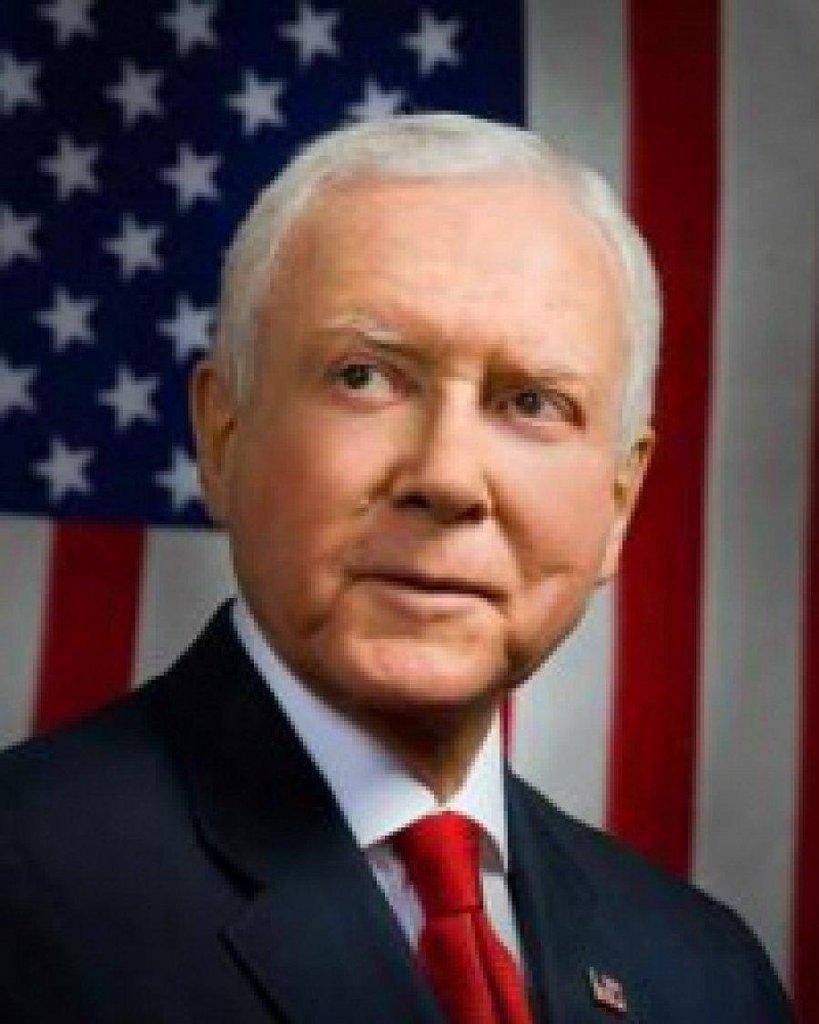

In a speech on the Senate floor, U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, today reiterated former President Clinton’s call to extend all the tax rates that are set to expire on January 1st. Hatch said it was imperative President Obama and Congress stop playing election year politics and instead act now to prevent the largest tax hike in American history from taking place. To watch Hatch’s speech, clickВ HERE.

“If the President and his campaign team think that they can punt this issue into the fall they are sorely mistaken. The American people will voice their displeasure with this failure to lead in November,” said Hatch. “President Clinton got it right the first time yesterday. The fiscal cliff must be addressed now. We cannot wait until later in the year.”

Yesterday On CNBC, President Clinton said that extending “all the tax cuts due to expire at the end of the year” is “probably the best thing we can do right now.”

“There is no greater jobs program that Congress and the President could pursue than a permanent extension of the tax relief signed by Presidents Bush and Obama,” said Hatch. “It would provide enormous confidence to America’s businesses and families at a time when confidence is sorely needed. This issue is not going away, and I look forward to working with my colleagues to pass tax relief for all Americans sometime this summer.”

In May, Hatch ledВ a letter to Senate Majority Leader Harry Reid (D-Nev.) urging him to start working with Republicans to prevent these massive tax hikes given the impact on the economy.В The Congressional Budget Office (CBO) found that if these tax hikes are not prevented that the economy could be pushed into another recession.

Below is the text of Hatch’s full speech delivered on the Senate floor today:

Mr. President, the bad news keeps coming. Europe is in dire straits, with the debt-riddled economies of Greece, and now Spain, threatening the future of the continent’s economic union. There is real concern that this debt-fueled contagion in Europe will undermine our economy as well.

And our economy cannot take too many more hits. The unemployment rate went back up to 8.2 percent last month. В Only 69,000 net new payroll jobs were created.

That is barely keeping up with population growth, and is hardly the type of robust job growth that will be the foundation of a lasting and meaningful economic recovery.

We should have seen this coming.

The minutes of the Federal Reserve’s most recent monetary policymaking meeting makes numerous mention of uncertainties surrounding fiscal policy, and that those uncertainties are a risk to the economic outlook.

Fed policymakers noted that:

“They generally saw the U.S. fiscal situation also as a risk to the economic outlook; if agreement is not reached on a plan for the federal budget, a sharp fiscal tightening could occur at the start of 2013.”

They concluded that “uncertainty about the trajectory of future fiscal policy could lead businesses to defer hiring and investment.”

And “uncertainty about the fiscal environment could hold back both household spending on durable goods and business capital expenditures.”

Yesterday the Congressional Budget Office reminded us yet again what the consequences will be to our economy if we fail to get our debt under control.

According to one of their analyses, absent serious reform of entitlement spending programs, “Federal debt would grow rapidly from its already high level, exceeding 90 percent of GDP in 2022. After that…[d]ebt as a share of GDP would exceed its historical peak of 109 percent by 2026, and it would approach 200 percent in 2037.”

The impact of this multiplying debt will be a Gross National Product that is reduced by 4.5 percent in 2027 and 13.5 percent in 2037.

In other words, unless President Obama and his allies in the Senate get to work, Americans face a future of fewer jobs, flat or shrinking incomes, and loss of opportunity. And the sad truth is as this chart shows, the President’s allies have not gotten to work. It was no surprise, therefore, when former President Clinton stated yesterday that we were still in a recession. Economists might say that is not technically accurate. But it is certainly how many Americans feel.

What did come as a surprise, however, were President Clinton’s remarks on Taxmageddon, the fiscal cliff that the nation faces at the end of this year.

At least yesterday, it sounded like his view was that we should do a complete 180 and race away from this cliff, extending in full the tax relief enacted by President Bush and extended by President Obama in 2010.

Several weeks ago, 41 Senate Republicans made a similar request of the Senate’s Majority Leader, Senator Reid.

This fiscal cliff is unquestionably contributing to our fiscal crisis and slowing the economy by creating enormous uncertainty for taxpayers and businesses.

Absent action to extend this tax relief, Americans will be hit with a $310 billion tax increase next year alone.

Twenty-six million middle income families will owe $92 billion in Alternative Minimum Tax when filing their returns one year from now.

A family of four, earning $50,000, will get hit with a $2,183 tax hike. В A small business owner will face a top marginal tax rate hike of 17 percent. The number of farmers who will face the death tax will rise by 2,200 percent. The number of small business owners who will face the death tax will rise by 900 percent. There should be no higher priority for the President and Congress than addressing these tax increases.

Yesterday, President Clinton seemed to agree, arguing that we should act now, not after the elections, to avoid the fiscal cliff.В At a minimum, he concluded that a temporary extension of current tax relief was in order.

“They will probably have to put everything off until early next year. That’s probably the best thing to do right now.”

Now, I understand that the minority leader of the Senate and the Speaker of the House have now called for a one-year extension during which time we should do tax reform, and that makes sense. I’m committed as the Ranking member on the Senate Finance Committee, to do tax reform and hopefully bring both sides together for once in a long time to do what it is in the best interest of this country.

Now, President Clinton further argued:

“What I think we need to do is to find some way to avoid the fiscal cliff, to avoid doing anything that would contract the economy now, and then deal with what’s necessary in the long-term debt-reduction plan as soon as they can, which presumably will be after the election.”

Now, channeling Gilda Radner — and presumably following a dressing down by President Obama’s campaign team — President Clinton tells us Never Mind.

But President Clinton knew what he was saying.

He was making an elementary point, one that the President Obama seemed to agree with when he was not running for reelection on a platform that single-mindedly obsesses over raising taxes on families with incomes over $250,000.

President Clinton, not wanting to further undermine our economy, recommended a short-term extension of all the tax relief. That is precisely what President Obama agreed to at the end of 2010.

And given our tepid economic growth and job creation, and the threat from Europe, commonsense would dictate a similar course today, certainly if the alternative is a $310 billion tax increase.

But today President Obama is running for reelection, and tax relief for the so-called rich would undermine his message of wealth redistribution. Failure to extend this tax relief is not an option.

Just this morning, another Obama supporter and former director for the National Economic Council Larry Summers said,

“The real risk to this economy is on the side of slow down…and that means we’ve got to make sure that we don’t take gasoline out of the tank at the end of this year. That’s gotta be the top priority.”

The former Director of President Obama’s Office of Management and Budget concluded that what he estimates to be a $500 billion tax increase would be so large that “the economy could be thrown back into a recession.”

According to the magazine The Economist, the Congressional Budget Office has found that the combined effects of the sequester and the expiring tax relief would add up to 3.6 percent of GDP in fiscal year 2013.В In a $15 trillion economy, that would be a hit to GDP of $540 billion which would surely tip us toward recession and even more job losses.

So the question that the people of Utah, and citizens around the country, are asking themselves is what’s the holdup?

If extending this tax relief is essential to providing families and businesses with the certainty and security necessary for economic growth, why are Senate Democrats refusing to take it up?В And why is the President not pushing for immediate action to avoid this fiscal cliff?

Let me suggest an answer.

The President wants to drag this out until after the elections. Even if that means months of additional pain for America’s families and a real hit to our economy, it will serve his long-term goal — a goal that he dares not announce until after the election.

President Obama does not want the precedent of extending this tax relief for everyone because ultimately his liberal base does not want it extended for anyone.

The President and his advisors know that our debt is unsustainable.В Their base will not allow for any serious changes to spending policy, and tax increases on the wealthy alone are not adequate to get our fiscal house in order.

The only solution — one that Hyde Park and Pennsylvania Avenue are loathe to discuss openly — are tax increases on everybody.

This is Matt Bai writing last year in the New York Times.

If Democrats are serious about reversing the policy of the Bush years, then they will probably have to be willing to make a case for eliminating all the tax cuts, not just those for the wealthiest Americans.В And they may have to come up with some kind of more comprehensive plan for modernizing the entire tax code, in order to persuade voters that even if some taxes go up, they might still come out ahead.

Ezra Klein, the liberal blogger at The Washington Post, put it this way.

“We cannot fund anything close to the government’s commitments if we don’t raise taxes, or if we let only the Bush tax cuts for income over $250,000 expire.”

And though he is now persona non grata in President Obama’s camp, just a few weeks ago President Clinton was echoing this recommendation of tax increases for all.

“This is just me now, I’m not speaking for the White House — I think you could tax me at a 100 percent and you wouldn’t balance the budget. We are all going to have to contribute to this, and if middle class people’s wages were going up again, and we had some growth to the economy, I don’t think they would object to going back to tax rates [from] when I was president.”

Well, with due respect to the former President, I do think that he was speaking for the White House, and I do think that most Americans would object to a tax hike.

That is why President Obama has decided to lay low rather than lead.

The American people are not going to accept this.В We live in a republic.В And it is fundamentally illegitimate on an issue of this magnitude for a person running for President to put these decisions off until a lame-duck session of Congress when he can no longer be held to account by the American people.

It is not only an economic imperative that we extend this tax relief.В It is demanded by our constitutional commitment to representative democracy.

To borrow from Justice Scalia, the American people love democracy and the American people are not fools.

And if the President and his campaign team think that they can punt this issue into the fall they are sorely mistaken. The American people will voice their displeasure with this failure to lead in November.

President Clinton got it right the first time yesterday. The fiscal cliff must be addressed now.В We cannot wait until later in the year. Our economy is struggling.В American families are treading water. We have tried it their way for almost 4 years. We have tried an $850 billion stimulus. We have tried Obamacare, which was also supposed to be a jobs program. We have tried Dodd-Frank. It is time to try something else.

There is no greater jobs program that Congress and the President could pursue than a permanent extension of the tax relief signed by Presidents Bush and Obama.

It would provide enormous confidence to America’s businesses and families at a time when confidence is sorely needed.

This issue is not going away, and I look forward to working with my colleagues to pass tax relief for all Americans sometime this summer.