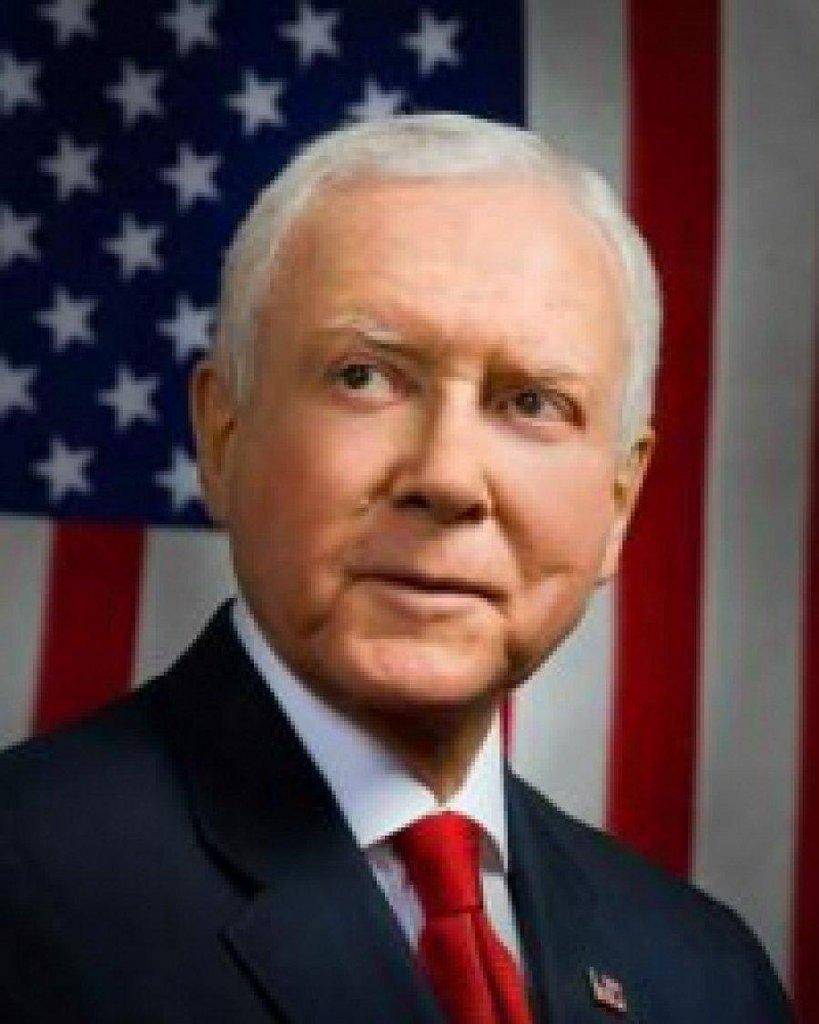

After the Internal Revenue Service (IRS) signaled its intent to consider proposed changes to the tax treatment of non-profit 501(c)(4) organizations, 10 Senators today asked IRS Commissioner Shulman to clarify the agency’s intentions for the 52-year-old regulation. In a letter led by U.S. Senator Orrin Hatch (R-Utah), Ranking Member of the Senate Finance Committee, the lawmakers questioned the IRS’s response to a public rulemaking petition from outside groups pressuring the agency to take action on 501(c)(4)s and said it was essential that politics not play any role in its decision-making process.

“We believe these petitions have less to do with concerns about the sanctity of the tax code and more about setting the tone for the upcoming presidential election, and we urge you to resist allowing the IRS rulemaking process to be subverted to achieve partisan political gains,”wrote the Senators.

On July 17th in a letter to petitioners, the IRS said it “was aware of the public interest” in 501(c)(4)s and that it “will consider proposed changes,” raising questions on whether the agency has already started a an internal process to amend its regulations.

The Senators continued, “Your acknowledgement of the political character of the public interest in 501(c)(4) organizations would caution against sudden changes to well-established law. Yet, your letter seems to suggest that outside political pressure is actually what is triggering your agency’s considering of changes to the law.”

Joining Hatch on the letter are Senators Chuck Grassley (R-Iowa), Jon Kyl (R-Ariz.), Pat Roberts (R-Kan.), Mike Enzi (R-Wyo.), John Cornyn (Texas), John Thune (R-S.D.), Mitch McConnell (R-Ky.), Lamar Alexander (R-Tenn.), and Kay Bailey Hutchison (R-Texas).

Earlier this year, a dozen Republican Senators called on the IRS to prevent politics from playing a role in any action taken on non-profit 501(c)(4) organizations after several groups applying for the status received excessive follow-up inquiries from the agency. A similar group, questioned the agency’s preservation of privacy protections for these groups in June.

To view a signed copy of the letter clickВ HERE.В

Below is the full text of the letter:

August 6, 2012

Hon. Douglas H. Shulman

Commissioner

Internal Revenue Service

1111 Constitution Avenue, NW

Washington, DC 20230

В

Dear Commissioner Shulman:

As you are aware, we have written to you on different occasions on tax issues relating to social welfare organizations organized under section 501(c)(4) of the Internal Revenue Code (IRC).В As we continue to monitor developments in this field, we are concerned about a recent letter from the Internal Revenue Service (IRS) to private groups suggesting that a 52-year-old regulation is now being reconsidered.

On July 17, 2012, the IRS responded to outside organizations that had previously sent a “petition for rulemaking on candidate election activities by Section 501(c)(4) groups.” The IRS characterized the letter it received as “urging the IRS to institute a rulemaking proceeding to address the rules related to political activity by organizations exempt under section 501(c)(4) of the Internal Revenue Code.”

В

In response to this letter, the IRS replied in part:

“The IRS is aware of the current public interest in this issue. These regulations have been in place since 1959. We will consider proposed changes in this area as we work with the IRS Office of Chief Counsel and the Treasury Department’s Office of Tax Policy to identify tax issues that should be addressed through regulations and other published guidance.”

As you know, matters involving 501(c)(4) organizations have become deeply politicized.В As an example, several of our Senate colleagues sent a letter to you on March 12, 2012, asking the IRS to “immediately change the administrative framework for enforcement of the tax code as it applies to groups designated as вЂsocial welfare’ organizations.” The Senators further “urge[d]” the IRS to make three administrative changes “immediately.”  We believe these petitions have less to do with concerns about the sanctity of the tax code and more about setting the tone for the upcoming presidential election, and we urge you to resist allowing the IRS rulemaking process to be subverted to achieve partisan political gains.

The IRS staying outside the political realm is critical for public confidence in your agency. For that reason, we are troubled by the ambiguity of your response to this public petition. Your response raises questions about whether the IRS has already begun an internal process to amend this 52-year-old regulation. The revision of such a technical regulation would necessitate lengthy and deliberative evaluation of the myriad issues involved in such an action. The evaluation period for such an action normally begins with the IRS Priority Guidance Plan. The Priority Guidance Plan serves the purpose of allowing the general public and interested parties to review the initiatives which the IRS believes are most worthy of attention. Given that the IRS has finite resources to devote to important tasks, it utilizes this plan to focus on items that are most important to taxpayers. We note that the 2011-2012 Priority Guidance Plan and three subsequent quarterly updates make no mention of addressing the rules related to political activity by 501(c)(4) exempt organizations. Therefore it would be highly extraordinary for you to effect the administrative changes asked for in the letter of March 12, 2012 “immediately.”

Your acknowledgement of the political character of the public interest in 501(c)(4) organizations would caution against sudden changes to well-established law. Yet, your letter seems to suggest that outside political pressure is actually what is triggering your agency’s considering of changes to the law. Though we do not claim to know what action is being contemplated by the IRS, public confidence in the non-partisan integrity of the agency demands that you issue no sub-regulatory guidance nor engage in any similar efforts that would effectuate immediate changes without a lengthy period of review, separated in time from the current heated political environment. Taking such an action would not be consistent with past agency practice.

The regulatory process should be measured, and undertaken with great care.В Federal tax regulations provide the official interpretation of the Internal Revenue Code (IRC) by the Treasury Department. Their importance cannot be understated.В The amending of one such regulation, particularly one of such consequence as relating to social welfare organizations, requires strict compliance with the federal rulemaking process.

While we express no opinion at this time as to the merits of any specific recommended amendment to regulations related to organizations exempt under IRC 501(c)(4), we are concerned that the IRS would consider bypassing the normal rulemaking process in direct response to pressure from public officials and outside special interest groups seeking political gain.В In order to clarify any ambiguity, we respectfully request that you provide specific information to us as to whether your organization has begun a process of drafting possible changes to the regulations governing eligibility for section 501(c)(4) tax-exempt status, and the exact mechanism you would utilize to effectuate these changes (including a time frame).