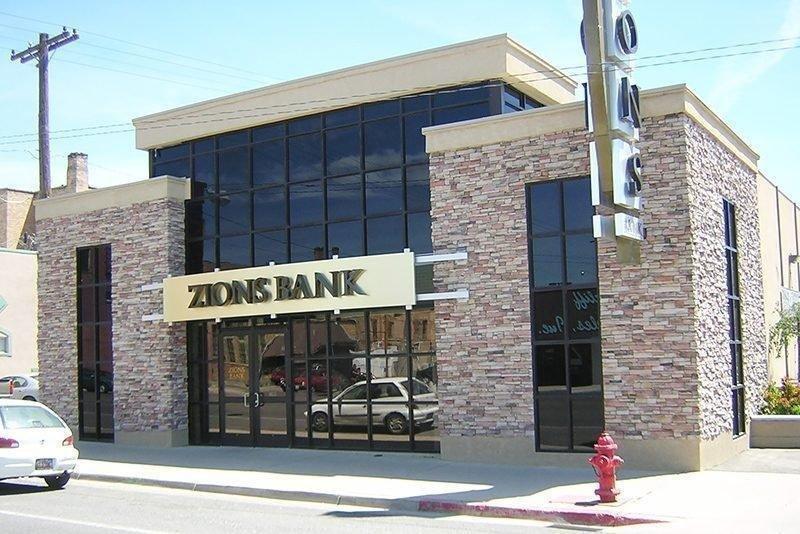

Zions Bank Press Release

Zions Bank announced today that is has processed and obtained approval on just over 12,400 Paycheck Protection Programs (PPP) loans, totaling $1.78 billion, as of Monday, May 11. These loans were made to small businesses in Utah, Idaho and Wyoming.

In Utah, Zions Bank has received approvals on 9,554 loans, totaling $1.34 billion, nearly a quarter (24.8%) of PPP funding approved in the state since the Small Business Administration (SBA) loan program began on April 3. The funding will help preserve payrolls for 143,700 Utah workers based on applicant data.

More than 75% of loans approved were for amounts less than $100,000 and more than 70% of loans were made to businesses with 10 employees or fewer. The median loan size of the loans processed by Zions Bank in Utah was $34,300.

Zions Bank will continue processing PPP applications until the more than $100 billion in remaining PPP funds are exhausted. As of Friday, May 8, the SBA had approved $189 billion of the $310 billion in round two funding. Small businesses, independent contractors, self-employed individuals or non-profits that qualify and have not yet applied for a loan through this program can visit www.zionsbank.com/cares to begin the application process.

As small businesses struggle for much-needed capital in the wake of the coronavirus crisis, Zions Bank knew it had to help entrepreneurs as the top SBA lender in its market.

“Our deep and longstanding relationships in the communities we serve allowed the bank to process Paycheck Protection Program loan applications on an unprecedented level, both for existing clients and new clients,” said Scott Anderson, Zions Bank President and CEO. “Employees have worked around the clock and through weekends on behalf of businesses that represent a broad cross section or demographic groups and geographic areas. We did it because, as the top SBA lender in our market, we knew we had to deliver for local entrepreneurs facing economic challenges.”

Claudia Lamas, owner of Claudia’s Child Care in Salt Lake City, said she spent weeks seeking help from various financial institutions, including the one she has an account with, before she emailed a Zions Bank employee who responded to her within hours. Lamas applied for the loan through Zions on the afternoon of April 29 and her $5,100 loan application was approved the next morning.

“I wasn’t a customer, I wasn’t a big business,” Lamas said. “My budget is tiny, but they said you qualify, and they treated me like an important client.”

The PPP loans also benefitted Utah non-profit organizations, including Columbus Community Center, which serves individuals with disabilities through housing, employment, training and day activities. As its different lines of business began to dwindle in mid-March, the organization was making plans to furlough 20 members of it 250-person workforce on April 2, but the chance for a Paycheck Protection Program loan through Zions Bank gave them a lifeline.

“This loan was a saving grace. We’re feeling so much better,” said Columbus Community Center CEO Kristy Chambers. “Without the certainty that we would have the ability to preserve our workforce, we wouldn’t be able to innovate and adapt in creative ways.”